Are Home Prices Going Up or Down? That Depends…

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here’s an explanation of each.

Year-over-Year (Y-O-Y):

- This comparison measures the change in home prices from the same month or quarter in the previous year. For example, if you’re comparing Y-O-Y home prices for April 2023, you would compare them to the home prices for April 2022.

- Y-O-Y comparisons focus on changes over a one-year period, providing a more comprehensive view of long-term trends. They are usually useful for evaluating annual growth rates and determining if the market is generally appreciating or depreciating.

Month-over-Month (M-O-M):

- This comparison measures the change in home prices from one month to the next. For instance, if you’re comparing M-O-M home prices for April 2023, you would compare them to the home prices for March 2023.

- Meanwhile, M-O-M comparisons analyze changes within a single month, giving a more immediate snapshot of short-term movements and price fluctuations. They are often used to track immediate shifts in demand and supply, seasonal trends, or the impact of specific events on the housing market.

The key difference between Y-O-Y and M-O-M comparisons lies in the time frame being assessed. Both approaches have their own merits and serve different purposes depending on the specific analysis required.

Why Is This Distinction So Important Right Now?

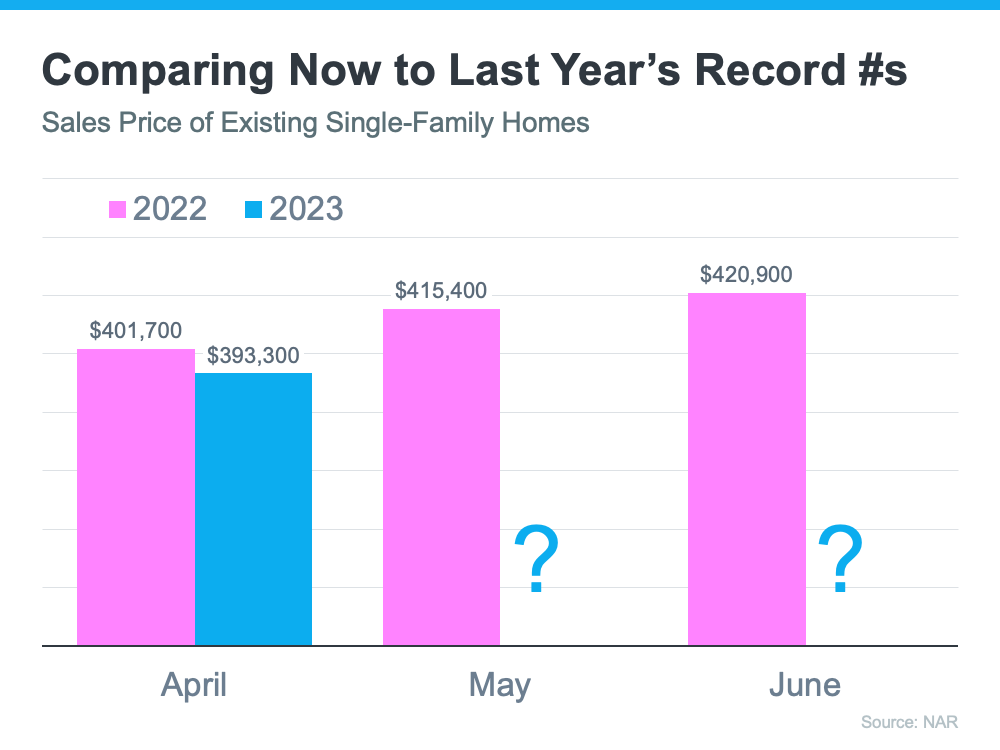

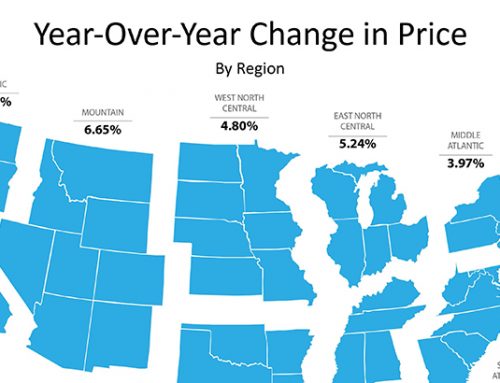

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year. April, May, and June of 2022 were three of the best months for home prices in the history of the American housing market. Those same months this year might not measure up. That means, the Y-O-Y comparison will probably show values are depreciating. The numbers for April seem to suggest that’s what we’ll see in the months ahead (see graph below):

That’ll generate troubling headlines that say home values are falling. That’ll be accurate on a Y-O-Y basis. And, those headlines will lead many consumers to believe that home values are currently cascading downward.

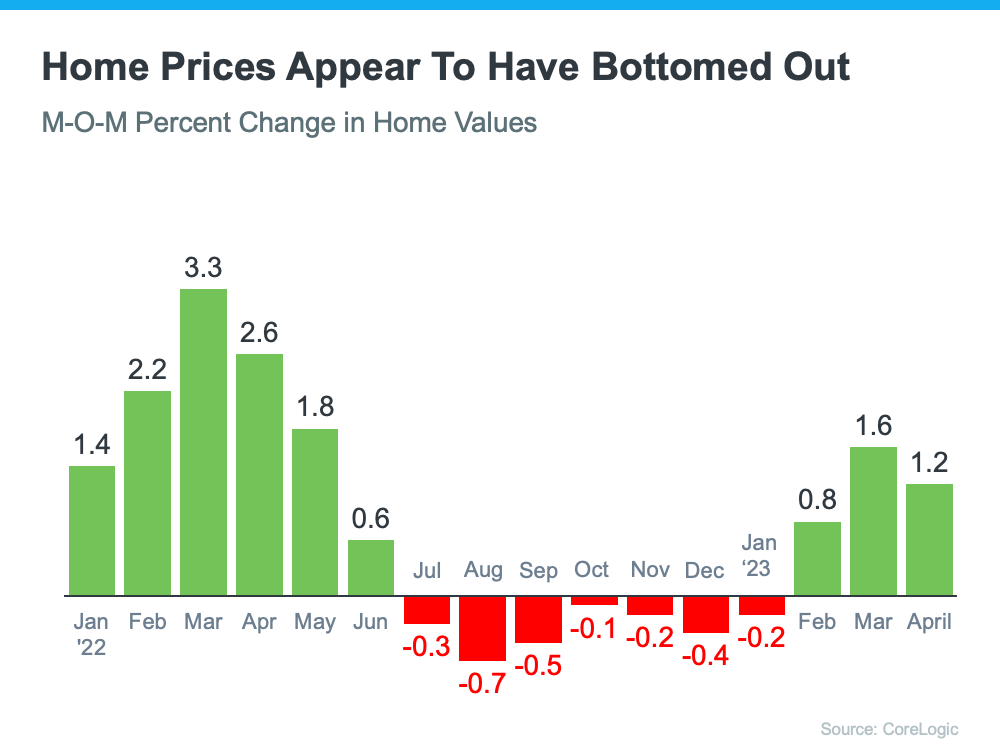

However, on a closer look at M-O-M home prices, we can see prices have actually been appreciating for the last several months. Those M-O-M numbers more accurately reflect what’s truly happening with home values: after several months of depreciation, it appears we’ve hit bottom and are bouncing back.

Here’s an example of M-O-M home price movements for the last 16 months from the CoreLogic Home Price Insights report (see graph below):

Why Does This Matter to You?

So, if you’re hearing negative headlines about home prices, remember they may not be painting the full picture. For the next few months, we’ll be comparing prices to last year’s record peak, and that may make the Y-O-Y comparison feel more negative. But, if we look at the more immediate, M-O-M trends, we can see home prices are actually on the way back up.

There’s an advantage to buying a home now. You’ll buy at a discount from last year’s price and before prices start to pick up even more momentum. It’s called “buying at the bottom,” and that’s a good thing.

Bottom Line

If you have questions about what’s happening with home prices, or if you’re ready to buy before prices climb higher, let’s connect.

Planning to buy? Get your search of homes for sale in Pittsburgh started.

Planning to sell? Download your free home seller’s guide.

Are you relocating to the Pittsburgh area? I can make your move stress-free.

Explore our communities, and then give me a call at (724) 309-1758.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Christa Ross does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Christa Ross will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

![How To Get Your House Ready To Sell in 2025 [VIDEO]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/11/gettingreadytosell-500x383.jpg)

![Find Your Dream Home with an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/dreamhome-500x383.png)

![Buying A Home? 7 Reasons To Hire an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/7reasons-500x383.png)

![Your Buyer’s Agent Wears Many Hats [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/manyhats-500x383.jpg)

![Housing Market Forecast for the Rest of 2023 [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2023/08/housingmarketforcast-500x383.jpg)

![Reasons To Sell Your House Today [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2023/05/reasonstosellyourhome-500x383.jpg)

![More Listings Are Coming onto the Market [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2022/06/Morelistings-500x383.jpg)

![Spring Cleaning Checklist for Sellers [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2022/03/infographic-500x383.jpg)

![What’s Causing Today’s Competitive Real Estate Market? [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/10/infographic_competative-500x383.jpg)

![Financial Fundamentals for Homebuyers [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/01/financialfundamental_feature-500x383.jpg)

![Expert Forecast on the 2021 Housing Market [VIDEO]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/01/20210105-KCM-Share-2-500x383.jpg)

![Where Is the Housing Market Headed for the Rest of 2020? [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/08/20200730-MEM-1380x2048-1-500x383.jpg)

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/04/housingrecession-500x383.jpg)

![What You Can Do to Get Your House Ready to Sell [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/04/housereadytosell-500x383.jpg)

![10 Steps to Buying a Home This Summer [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/07/10stepstobuying_feature-500x383.jpg)

![4 Reasons to Sell This Summer [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/06/4Reasons_KCM-500x383.jpg)

![5 Reasons Why Millennials Buy a Home [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/04/Millennials-Choose-to-Buy-ENG-MEM1-1046x1354-500x383.jpg)

![Existing Home Sales Slow to Start Spring [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/04/existinghomesale-500x383.jpg)