Are We in a Housing Bubble? Experts Say No.

The question of whether the real estate market is a bubble ready to pop seems to be dominating a lot of conversations – and everyone has an opinion. Yet, when it comes down to it, the opinions that carry the most weight are the ones based on experience and expertise.

Here are four expert opinions from professionals and organizations that have devoted their careers to giving great advice to the housing industry.

The Joint Center for Housing Studies in their The State of the Nation’s Housing 2021 report:

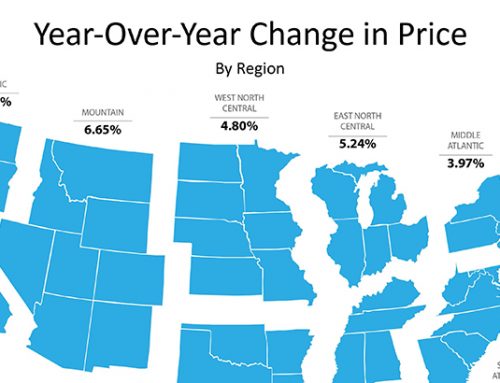

“… conditions today are quite different than in the early 2000s, particularly in terms of credit availability. The current climb in house prices instead reflects strong demand amid tight supply, helped along by record-low interest rates.”

Nathaniel Karp, Chief U.S. Economist at BBVA:

“The housing market is in line with fundamentals as interest rates are attractive and incomes are high due to fiscal stimulus, making debt servicing relatively affordable and allowing buyers to qualify for larger mortgages. Underwriting standards are still strong, so there is little risk of a bubble developing.”

Bill McBride of Calculated Risk:

“It’s not clear at all to me that things are going to slow down significantly in the near future. In 2005, I had a strong sense that the hot market would turn and that, when it turned, things would get very ugly. Today, I don’t have that sense at all, because all of the fundamentals are there. Demand will be high for a while, because Millennials need houses. Prices will keep rising for a while, because inventory is so low.”

Mark Fleming, Chief Economist at First American:

“Looking back at the bubble years, house prices exceeded house-buying power in 2006 nationally, but today house-buying power is nearly twice as high as the median sale price nationally…

Many find it hard to believe, but housing is actually undervalued in most markets and the gap between house-buying power and sale prices indicates there’s room for further house price growth in the months to come.”

Bottom Line

All four strongly believe that we’re not in a bubble and won’t see crashing home values as we did in 2008. And they’re not alone – Goldman Sachs, JP Morgan, Morgan Stanley, and Merrill Lynch share the same opinion.

Planning to buy? Get your search of homes for sale in Pittsburgh started.

Planning to sell? Download your free home seller’s guide.

Are you relocating to the Pittsburgh area? I can make your move stress-free.

Explore our communities, and then give me a call at (724) 309-1758.

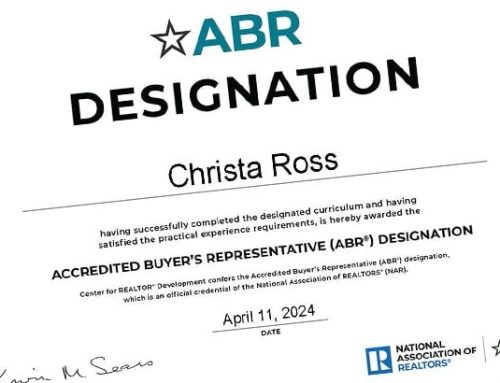

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Christa Ross does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Christa Ross will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

![Find Your Dream Home with an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/dreamhome-500x383.png)

![Buying A Home? 7 Reasons To Hire an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/7reasons-500x383.png)

![Your Buyer’s Agent Wears Many Hats [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/manyhats-500x383.jpg)

![Housing Market Forecast for the Rest of 2023 [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2023/08/housingmarketforcast-500x383.jpg)

![More Listings Are Coming onto the Market [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2022/06/Morelistings-500x383.jpg)

![Financial Fundamentals for Homebuyers [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/01/financialfundamental_feature-500x383.jpg)

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/04/housingrecession-500x383.jpg)

![5 Reasons Why Millennials Buy a Home [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/04/Millennials-Choose-to-Buy-ENG-MEM1-1046x1354-500x383.jpg)