Understanding Allegheny County Property Tax Assessments

In Allegheny County, the assessed value of homes is determined by the Allegheny County Office of Property Assessments. The county uses a base year, a designated year during a reassessment process when assessed values of properties are established. The base year serves as the foundation for property taxation until the next reassessment occurs. As of 2023, the current base year used by Allegheny County is 2012. This means homes today are assessed to reflect values during the year the last county-wide assessment was completed. The base year provides stability in property tax assessments. To calculate an assessment, the county determines the home’s current value based on recent sales and comparables and multiplies it by the Common Level Ratio.

Common Level Ratio in Allegheny County

The common level ratio is important in determining the accuracy of property assessments. Each year the assessment office collects data on market values. A statistical analysis is used to calculate the average ratio of current sales compared to the base year. This ratio is used to adjust new property assessments to maintain fairness and equity within the tax system. It also helps address any disparities or inequities in assessments and ensures that properties are valued consistently based on their market worth. As of 2023, the common level ratio Allegheny County uses is 63.53%.

Assessment and Reassessment in Allegheny County

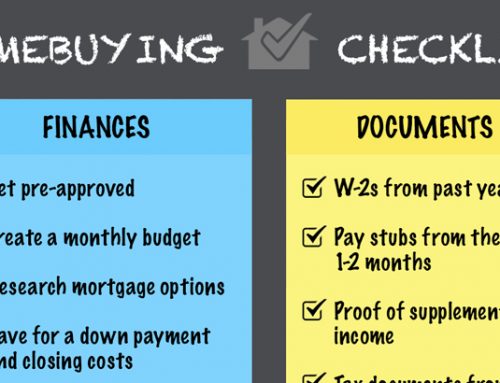

When a home sells for significantly more than its current assessment, an appeal may be filed by the school district or municipality based on their belief that the current assessed value does not reflect market value. The county then undertakes a reassessment process to determine the home’s market value. The market value is multiplied by the common level ratio to come up with a new assessed value. You can find information on the appeal process on the county website. The assessed value is multiplied by the tax rates (called millages) to calculate the total property taxes on a home. Allegheny County’s millage in 2023 is 4.73. Follow these links for the municipality and school district millages.

For homebuyers, looking at the current assessed value of a home is crucial when considering a purchase. A good rule of thumb is if the current assessed value is below 63.53% of the sale price, then you can likely expect some tax increase if you were to be reassessed.

Allegheny County Tax Appeals

Allegheny County Tax Appeals

Each year a homeowner has the option to file an appeal on the assessed value of their home. Another good rule of thumb is to consider the current value of your home and multiply it by the common level ratio for the year. If that amount is substantially lower than your current assessed value, filing an appeal may be a good idea. The application to appeal must be received by the property assessment office by March 31st. You can find complete information on appealing your taxes here.

You may also be notified of an appeal that has been filed by one of the taxing bodies. They may believe you are under-assessed and seeking to raise your assessed value, thereby increasing your property taxes. If you are notified of an assessment appeal, it is suggested you prepare and attend your assessment hearing.

Allegheny County Tax Abatements

The good news is there are tax abatement programs that can lower your property taxes. The most useful one is the Act 50 Homestead/Farmstead Exclusion. The Homestead/Farmstead Exclusion is a program that reduces your market value by $18,000 for county taxes only. To qualify, you must be the owner and occupy the dwelling as your primary residence. The application deadline is March 1 of each year. Once you have filed, your exemption will remain in effect until you sell/transfer the property or change your occupancy.

Other possible tax abatements are listed on the Allegheny County treasurer’s website.

Conclusion

In conclusion, understanding the concept of millage and property assessments is crucial for homeowners and homebuyers. The county’s use of a base year and the common level ratio helps maintain stability and fairness in property tax assessments. The common level ratio ensures that properties are valued consistently based on their market worth. The reassessment process may be undertaken when significant changes occur in a property’s market value. Homeowners have the opportunity to appeal their assessments if necessary.

It’s important for homebuyers to consider the assessed value of a property when making a purchase, as it can impact potential tax increases.

Additionally, exploring tax abatement programs can provide opportunities for reducing property taxes. For detailed information on tax appeals and abatements, homeowners can refer to the Allegheny County website or consult with their real estate agent. Contact me if you are interested in talking about how property taxes affect the affordability of your next home.

![Find Your Dream Home with an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/dreamhome-500x383.png)

![Buying A Home? 7 Reasons To Hire an Accredited Buyer’s Representative (ABR®) [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/7reasons-500x383.png)

![Your Buyer’s Agent Wears Many Hats [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2024/04/manyhats-500x383.jpg)

![Housing Market Forecast for the Rest of 2023 [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2023/08/housingmarketforcast-500x383.jpg)

![More Listings Are Coming onto the Market [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2022/06/Morelistings-500x383.jpg)

![Financial Fundamentals for Homebuyers [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2021/01/financialfundamental_feature-500x383.jpg)

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2020/04/housingrecession-500x383.jpg)

![5 Reasons Why Millennials Buy a Home [INFOGRAPHIC]](https://www.bestpittsburghhomes.com/wp-content/uploads/2019/04/Millennials-Choose-to-Buy-ENG-MEM1-1046x1354-500x383.jpg)